Extraordinary Push to Introduce NEW Taxes in Australia: What they will Mean for Your Wallet

By NICHOLAS WILSON, NEWS REPORTER, AUSTRALIA

Economists have warned that without bold tax reforms, such as introducing an inheritance tax, the Albanese government risks letting budget deficits spiral out of control.

In its first term of government, Labor oversaw two consecutive budget surpluses, driven in large part by unexpected company and personal tax windfalls.

But without stricter government spending and a dramatic overhaul of the tax system, those back-to-back surpluses, the first in 15 years, will remain ‘distant memories.’

These were the findings of Deloitte’s most recent Budget Monitor report, which said that, as it stood, the country was on track for budget deficits ‘as far as the eye can see.’

With the national debt set to top $1 trillion within months and a decade of budget deficits on the cards, the Albanese government needs to take tax reform seriously.

‘The single notable revenue-raising policy change taken to the May election – the proposed taxing of unrealised gains on large superannuation balances – has been watered down,’ Deloitte Access Economics partner Stephen Smith said.

‘Meanwhile, an unwelcome re-acceleration of inflation has erased any hope of a Christmas interest rate cut and has lifted cost-of-living back up the list of concerns facing the electorate.’

Deloitte proposed five key tax reforms, including indexing personal income tax thresholds, cutting company tax rates, broadening the GST, reducing the capital gains tax, and introducing an inheritance tax.

The Albanese government needs to put major tax reform on the table. The Prime Minister is pictured with Treasurer Jim Chalmers and Finance Minister Katy Gallagher

Deloitte Access Economics partner Stephen Smith said the Albanese government ‘watered down’ the only notable revenue-raising reform it took to the May election

Currently, Australia’s personal income tax thresholds are fixed. That means when wages rise due to inflation or career progression, people can be pushed into higher tax rates even if their real purchasing power hasn’t increased – a process called bracket creep.

To prevent this, Deloitte recommended a $33,000 tax-free threshold, a 33 per cent rate for income between $33,001 and $330,000, and a 45 per cent rate for income above that, with all thresholds indexed to inflation.

Mr Smith said the change could encourage low-income workers on government benefits to take on more work.

‘These reforms would remove the disincentive to work that comes from having a tax-free threshold well below the point at which someone no longer qualifies for income support,’ he said.

Deloitte estimated the move would cost up to $54 billion per year after ten years and would need to be accompanied by replacement sources of revenue.

To that end, the report also recommended increasing and broadening GST to 15 per cent, extending it to previously exempt items such as food and education.

This would raise an estimated $90 billion annually over the next decade.

It also recommended increasing government support payments to help offset any strain on low-income households, leaving the net budget gains at about $58 billion.

Inheritance tax and capital gains discount reforms would help to address property affordability and intergenerational earnings problems, Deloitte said

Among the more controversial proposals floated in the report concerns the inheritance tax, which Deloitte argued would help level the intergenerational playing field.

‘Broad-based taxes on wealth – such as an inheritance tax – are a way to repair the budget, help all Australians share in the asset price windfall that has flowed to older generations over the last 40 years, and help to prevent inequality from cascading through future generations,’ the report said.

‘Inheritance taxes – controversial though they are in Australia – are commonplace in other jurisdictions including the United States, the United Kingdom and much of Europe.’

It is estimated that a 10 per cent tax on inheritance, with a $100,000 tax-free threshold and an exemption for inheriting a primary residence, would raise an average of $3 billion per year over the decade to 2035–36.

Deloitte also proposed lowering the company tax rate to 20 per cent to encourage investment and better leverage the country’s abundant resources and skilled workforce.

To offset the revenue hit, businesses should be subjected to a ‘super profits’ tax, together bringing in about $12 billion per year over the next ten years.

Lastly, Deloitte proposed reducing the capital gains tax discount from 50 per cent to 33 per cent to better reflect inflation and improve fairness between asset holders and wage earners.

The reform would also help cool housing demand by reducing the tax advantage for investors in residential property, it said.

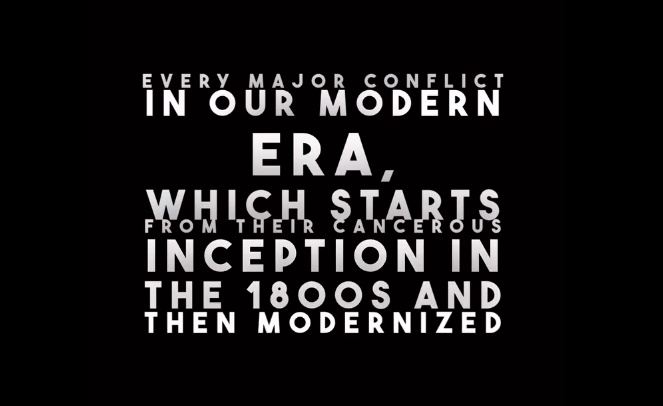

Government revenue and spending gaps are expected to more than double within a decade

Taken together, Deloitte said the reforms would add an average of $57 billion per year to the underlying cash balance over the next decade.

As things stand, the report said the gap between revenue and spending could more than double over the decade, from $34.2 billion in 2026–27 to $84.8 billion in 2035–36.

Net debt is projected to rise from 21.7 per cent to 29.6 per cent of GDP over the same period, leaving younger generations to shoulder a larger fiscal burden.

‘The intergenerational inequities that will result from clinging on to the current tax system are clear,’ Mr Smith said.

‘As debt mounts, and the reliance on personal income tax rises, the fiscal burden will disproportionately fall at the feet of younger, working-age Australians.

‘If not now, when?’