Reeves’s Pay-per-mile Tax ‘Risks Becoming Poll Tax on Wheels’

By Ben Riley-Smith

Electric vehicles face new levy as Chancellor scrambles to make up for falling fuel duty revenue

Electric vehicle (EV) drivers will be hit with a new pay-per-mile tax in the Budget, The Telegraph can reveal.

Under current plans, to be announced by the Chancellor on Nov 26, drivers of electric cars will be charged 3p per mile on top of other road taxes.

The scheme, set to kick in from 2028 after a consultation, will mean the average driver faces paying an extra £250 a year – which the president of the AA said risked becoming “a poll tax on wheels”.

The Treasury will make the move amid falling fuel duty revenue as people move from petrol to electric cars. Up to six million people are set to be driving EVs by the time the tax comes in.

Ministers will frame the move as one of fairness, as drivers of petrol cars currently pay £600 a year on average in fuel duty.

They will also argue that it is different from traditional pay-per-mile schemes, with a fee taken each year on estimated travel and no mass electronic monitoring of movements.

But AA president Edmund King said: “Whilst we acknowledge the Treasury is losing fuel duty revenue as drivers go electric, the Government has to tread carefully unless their actions slow down the transition to EVs.

“We need to see the detail of this proposal to ascertain whether these new taxes will be equitable or a poll tax on wheels.”

The approach also opens the door for the wholesale adoption of pay-per-mile taxation for all cars, raising questions about how the scheme would be enforced.

Sir Mel Stride, the Conservative shadow chancellor, said: “If you own it, Labour will tax it. It would be wrong for Rachel Reeves to target commuters and car owners in this way just to help fill a black hole she has created in the public finances.

“With Labour’s cost of living crisis, now is not the time to hit hard-working families and businesses with another tax raid.”

How the tax will work

For years, ministers and industry experts have discussed a pay-per-mile road taxation system that could be applied to all forms of cars.

While the specifics are still discussed, The Telegraph can reveal that the scheme would be aligned to the annual payment of vehicle excise duty (VED), which affects all UK motorists. EV drivers have had to pay the charge since April.

The new element is being described as “VED+” and being framed as a way to get drivers of green cars to pay more each year.

EV drivers will be asked to estimate the number of miles they will drive in the year ahead and pay a fee, set in the current plan at 3p per mile.

If the owner does not drive that amount, some of the money carries over into the next year. If they drive more miles than estimated, they would top up their payment.

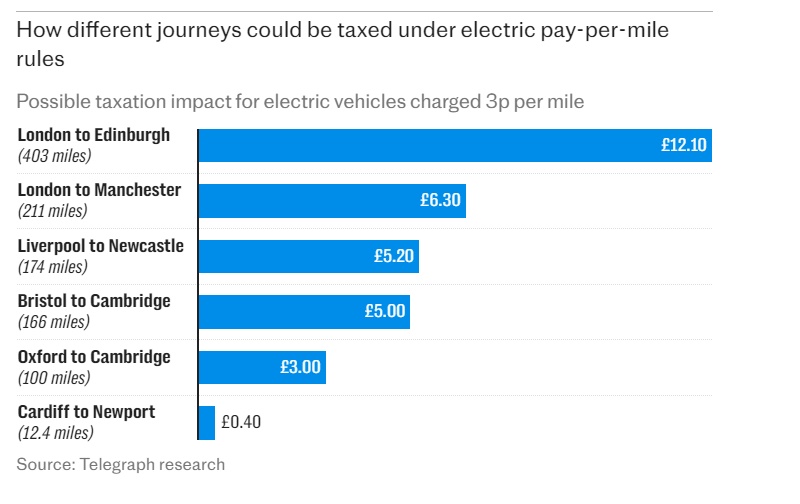

The 3p-per-mile charge means drivers face paying an extra £3 for a one-way journey between Cambridge and Oxford or £12 from London to Edinburgh.

Drivers of hybrid cars, which are powered by both petrol and electricity, will also have to pay the charge, but at a lower rate.

The move will raise the Treasury an estimated £1.8bn by 2031, helping the Chancellor to put the public finances on a more stable footing.

A Treasury spokesman declined to comment on Budget speculation.

The move comes after Ms Reeves warned that “all will have to contribute” to help repair Britain’s finances, suggesting a tax-heavy Budget in three weeks.

Previous governments have encouraged the transition from petrol and diesel cars to electric models to help bring down carbon emissions.

But the growing trend has created a tax revenue problem for the Chancellor, given that fuel duty – which fully electric cars avoid because they use no petrol – is a major money-raiser.

Treasury estimates suggest that by 2040, about £12bn will be lost in tax revenue because less petrol is being used.

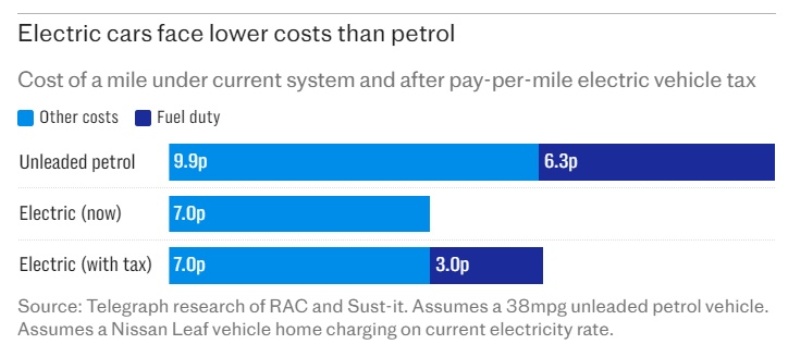

Ministers are preparing to argue that fuel duty already amounts to a pay-per-mile scheme in effect and note that petrol, on average, works out at 6p per mile.

The per-mile cost could rise in the future. Fuel duty was set at one penny, in old money, per gallon when introduced in 1908, but now stands at 52.95p per litre.

The move will also trigger questions about enforcement and whether it will be more intrusive than fuel duty, which is simply gathered via payments at the pump.

It raises the possibility that drivers could in future be made to prove how many miles they have travelled, such as with photographs of mileage counters, though this is not part of the current plan.

The Driver and Vehicle Licensing Agency will be tasked with overseeing the new tax. It already collects VED via cameras that scan number plates and with employees on patrol, with car details checked against a central database showing who has paid the fee.

A wider package of measures to support the EV sector is also being worked on, with the Government still wanting to incentivise people to adopt electric cars.

‘Another example of mixed messaging’

Mr King said the new scheme could put people off buying electric cars.

He told The Telegraph: “The Government has to get a balance. Obviously, on the one hand, they are paying grants for new EVs.

“On the other hand, there are proposals for a pay-per-mile extra tax, which could put some people off. It is a question of getting that balance of timing of when they introduced it. That is quite crucial.”

He added, of the choice for Government: “What do you want? Do you want to speed up the uptake of EVS? I think drivers know ultimately there will be a charge.

“It is more a question of the timing and whether it is right to flag that now for something that won’t come in for three years. Will that affect sales for the next three years?”

Meanwhile, political opponents accused Labour of an about-turn and of targeting drivers.

In November 2024, Ms Reeves said “we are not looking at road pricing” when questioned about the idea. One Conservative MP called it “another broken promise”.

‘People will feel blindsided’

Richard Holden, the Conservative shadow transport secretary, said: “We now have the grotesque chaos of a Labour Government – that came to power without a plan – using taxpayers money on the one hand to subsidise people to buy foreign made electric cars and on the other hand now wants to tax them for doing so as well as hit all other drivers with a fuel duty increase.”

Richard Tice, the deputy leader of Reform, said: “Rachel Reeves promised not to come back for more taxes. She lied. Not content with hammering farmers, pensioners and schools, she now has motorists in her sights.

“For years, net zero zealots have promised massive savings for motorists if they transitioned to electric vehicles, but that’s turning out to be completely false.”

Daisy Cooper, the Liberal Democrat Treasury spokesman, said: “It beggars belief that in the midst of a cost-of-living crisis and in the face of air pollution and rising respiratory diseases, the government is looking to hit people with an electric car tax.

“People who chose to buy an EV on the promise that it would be affordable will feel blindsided, and this would be yet another hit to Britain’s electric vehicle industry, which is already facing fierce competition from China.”

But some economists welcomed the move as a sensible way of replacing falling fuel duty revenues as people move away from petrol cars.

Paul Johnson, the former head of the Institute for Fiscal Studies, said pay-per-mile was not “perfect” but could be effective.

He wrote on X that the Government had “failed to act for too long” on dropping fuel duty revenues and said it was “absurd” to leave some cars “untaxed”.